When I was still a gradeschool student, my allowance was only P5.00 per day.

P2 sa juice, P3 sa sandwich.

Today, it would be very difficult for a child to survive on P5.00 a day.

Zesto pa lang P8 na.

With P2 now you can only buy 2 pieces of candy.

What is inflation?

Our biggest enemy is inflation.

Inflation is the increase of the prices of goods year after year after year.

Nothing and no one is exempted when inflation hits, including necessities and life’s comfort.

Sa ayaw natin at sa gusto. the prices of food, transportation, rent, electricity and other necessities will continue to increase.

If this blog is still being read in the next 10 years, a peso of that day might be equivalent to a centavo of today!

Inflation moves us financially backwards.

You and I know it exists, but we ignore it.

2015 I dreamt of venturing and saving up for a goat farm that cost P280,000. A year after the program charged P320,000 na.

What we do is, we just keep on working hard for our goals and dreams.

What we don’t realize is that inflation is moving us backward, further and further away from it.

The good news is that we can fight inflation.

2. What would happen if I don’t invest?

Inflation is invisible. Hindi mo napapansin everyday.

For example kasi, a 5% increase per year, is a 0.4% increase per month, at 0.01% increase per day.

Paano mo mapapansin yung impact diba?

You will realize the full impact, when you decide to retire, being financially constrained, and a financial burden to the ones you love most.

Imagine that you’re 65 years old and no longer working. Who will pay for your food, water, electricity, medicines, and doctor’s fees? Are you sure your pension will be able to cover for all of that?

That’s why I always say, the secret to a successful investing is TIME.

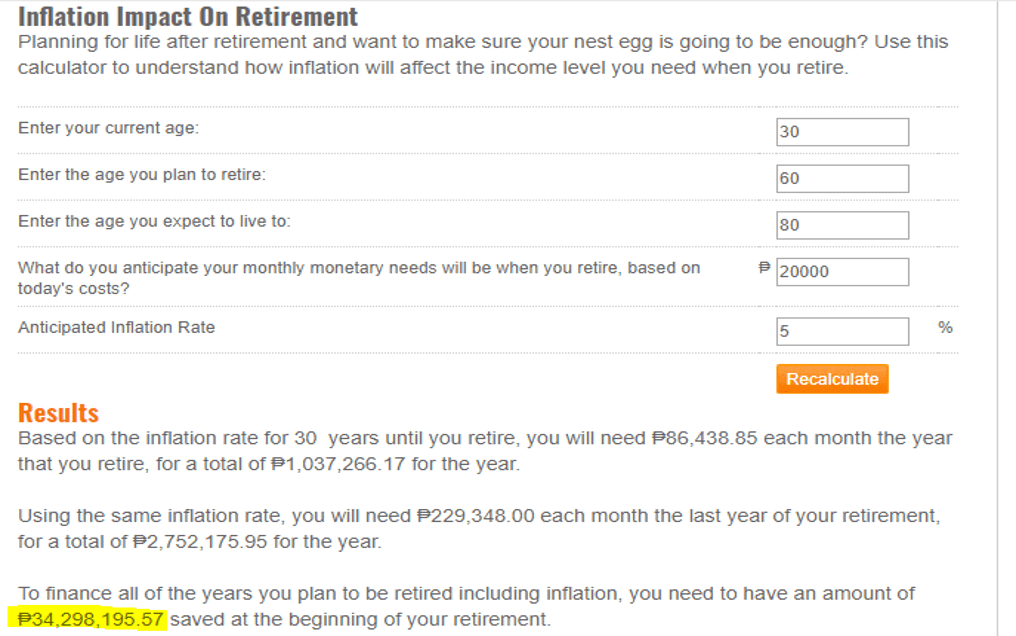

The Total Cost of Retirement is the amount of money that you’ll have to spend over the next 20 years after your retirement.

That’s the amount you need to have in preparation for your retirement.

If you doubt the numbers, go ahead and try to find a more specific answer.

What’s important is that you know and plan for your retirement because this is your future I’m talking about.

I sincerely hope that the amount you have seen scares you into acting immediately.

Investing is very easy to delay, easy to ignore, but the trade off is extremely painful.