BPI (Bank of the Philippine Islands) is typically the bank used by a lot of companies for their employee payrolls.

I am a BPI client for 8 years now, and I can say that they have been a huge part of my financial journey (not sponsored).

If asked what bank would I recommend, my answer would always be - select what’s easily accessible to you. If you’re living in Metro Manila, I’m sure you will agree that BPI branches are everywhere (well, same with BDO but that’s for another blog).

I’m lazy and hate to travel just for bank transaction, so I’ve been using online banking for bills payment and online transactions.

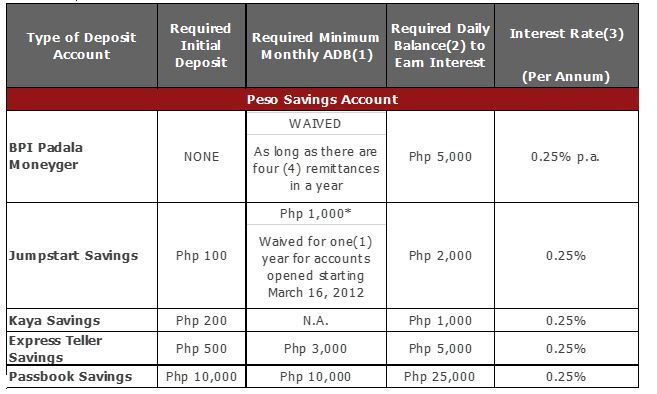

BPI Deposit Account Types

Affordable savings account that is specially designed for those who receive remittances from abroad. Safe and Secure.

Initially designed to teach habits of saving among children from 8 years old to 17 years old. It is an ATM savings account with special and cutting-edge features that children save their money at ease and keep their money safe.

Encourages Filipinos to save more – intimidation-free. No maintaining balance required, ₱200 initial deposit. Now, saving for your future is easy. No more excuses.

More convenient than you think. You can use it as a debit card and directly pay for your purchases at the cashier – no more long lines at the ATM to get cash!

Passbook Savings

If you favor the record keeping ease of a passbook, then, Passbook Savings is the sensible way to safe keep your money. Earn interest on your funds and monitor your account transactions the simple way.

Balance Requirements and Rates

Photo credit: BPI as of 4/1/2018

Bring 2 valid IDs - Passport, Driver’s License, PRC, NBI Clearance, Police Clearance, Postal ID, Voter’s ID, Barangay Certification, GSIS e-card, SSS card, Senior Citizen Card, OWWA ID, OFW ID, Seaman’s Book, etc.

BSP Reference: http://www.bsp.gov.ph/regulations/regulations.asp?type=1&id=2059

Your IDs should be:

- Original copy

- Photo-bearing (should be clear)

- Valid (unexpired)

Bring 1 Utility Bill

Even if it’s not named after you as long as you’re residing on the same address, it will do fine. Typical bills you can use: Electricity Bill, Water Bill, Internet Bill, Credit Card bills, and etc.

Bring 1x1 ID Picture

Bring Initial Deposit Amount – may differ for every deposit type account.

Step by Step Guide

- 1) Go to the nearest BPI bank and bring the requirements with you. Don’t forget to check their banking hours.

- 2) Tell the guard or bank teller that you will be opening a BPI savings account. Expect long queue. Tip: To kill boredom bring your phone or a book.

- 3) Inform the teller the savings type you wish to open. You will be given a form to fill out. Make sure all information is accurate, so don’t forget to double check.

- 4) You will then be asked to give the initial deposit amount and the teller will process your application.

- 5) Usually, they provide the ATM kit right after the application – but for some cases the teller will ask you to wait 2-3 days.

- 6) Activate the ATM card once received – instruction included in the kit they will provide.

- 7) Enroll to Online Banking. If you are using a smart phone, download the BPI App.

Online Banking 101

- Check your balance, transfer funds, pay bills and more.

- I was initially hesitant to use online banking due to security reason but I’ve been using it for 8 years and I never had problems with it.

- BPI has provided step by step process on how to enroll to online banking.

- https://www.bpiassetmanagement.com/pages/how-to-enroll-in-bpi-expressonline/

Hope this guide helps you start your financial journey, just as it helped mine. Although it may give you low interest rate, money kept in the bank is safe, highly liquid and kind of gives you a little bit more responsibility to save away.